Invest Confidently in Diverse Opportunities with Returns

Ranging Up To 18-22%*

Grow your investment wealth with high-growth properties that give you profit and peace of mind

Diversify your portfolio with carefully vetted real estate investments.

Dive into exclusive deals that are conservatively placed on the risk/return spectrum but offer higher returns than alternative investments.

Gain exposure into real estate typically hidden from the average investor with joint funding from our general partners who add sizeable financial contributions to help close every deal with ease.

Build Generational Wealth through our Proven Products

Average up to *18-22% ROI

500+ transactions

Average Hold Period: 3-7 years

Dividends Payouts:

First quarter of distributions + exit returns

Multifamily Apartments:

Residential Real Estate:

Investment Products

Private Equity Funds: Invest in high-performing private equity funds tailored for long-term stability. Our funds allow you to enjoy steady returns and tax advantages with minimal volatility.

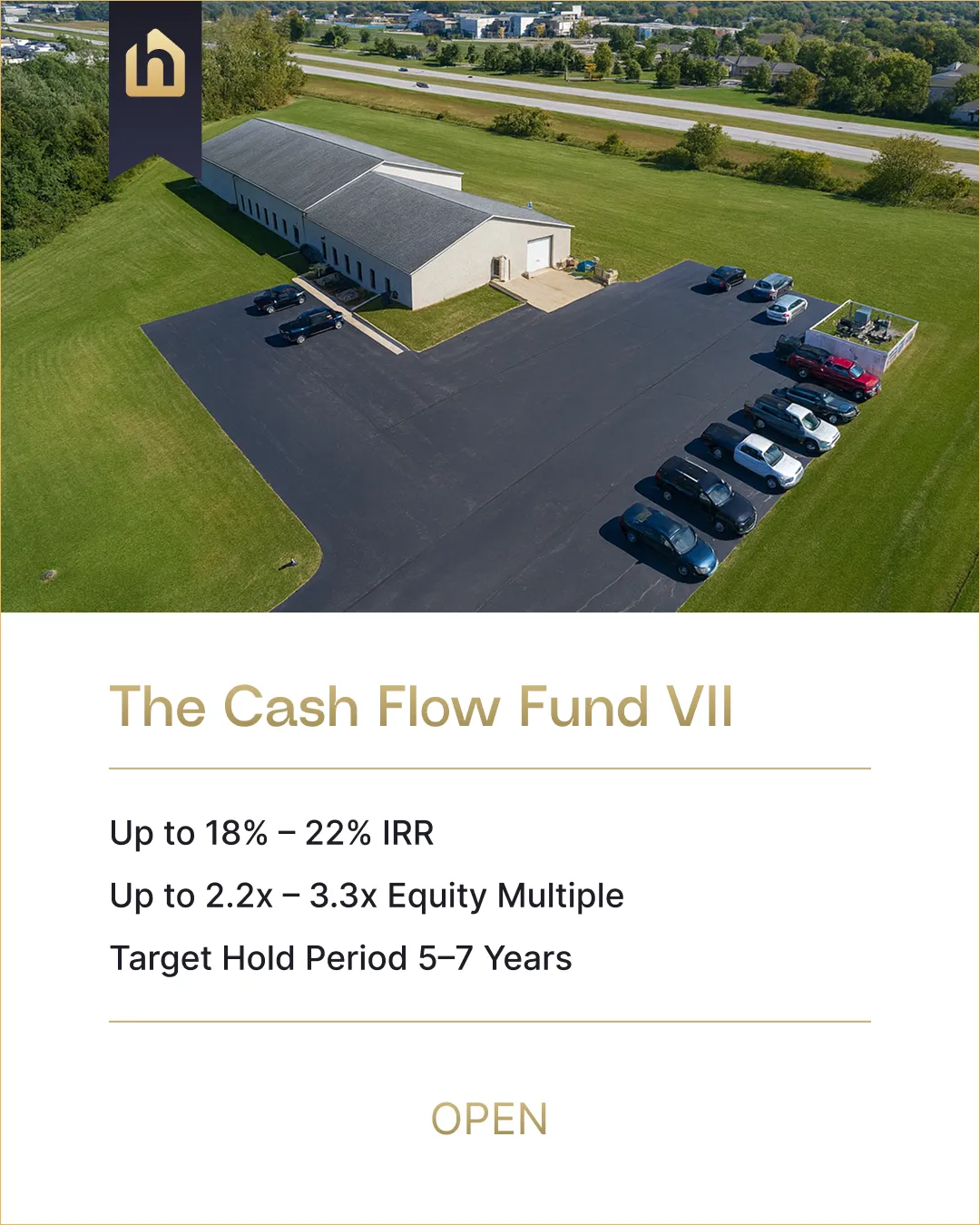

Discretionary Funds: Invest in funds with specific objectives that appeal to all investor participants (Ex: Cash Flow Fund VII or our Distressed Asset Value Fund I) and allows us to pick the assets that match their investment requirements.

Real Estate Syndications: Our syndication opportunities allow accredited investors to pool resources for lucrative, large-scale property investments. These syndications offer a balanced approach, combining accessibility with significant growth potential in both commercial and multifamily real estate.

One-Off Deal Acquisitions: Gain direct access to unique real estate acquisitions with strong growth potential. Through our carefully curated network, we bring exclusive properties to our investors, providing an ideal balance between high returns and risk management.

What we Invest in Together

We invest in carefully curated, financially accretive Killer Deals that return for our investors and our company.

$5-25M

Transaction size

A, B, C Asset Size:

Core or Value-Add in Multifamily, Industrial

Occupancy Rate:

70-100%. We welcome upside vacancy in our investments.

Hold Period 3- 7 years

How our Investment Strategy Works

Our strategy at Home Invest is rooted in ethical stewardship, rigorous due diligence, and a commitment to sustainable growth.

1

Source:

Our team identifies exclusive, off-market investment opportunities that are often inaccessible to individual investors.

2

Rigorous Due Diligence:

We conduct thorough market analysis and detailed vetting for each property, evaluating every aspect to optimize returns while managing risk.

3

Offer Terms & Financing:

Terms are negotiated, settled, and signed between all parties.

4

Deal Closing:

Home Invest provides the bank loans, and investors provide the down payment and upfront expenses. Tenants pay their rents and the business operates on positive cash flow.

5

Manage & Improve:

We transition ongoing management and resident relations to us. We work to lower expenses and start value add renovation of properties to improve performance.

6

Exit:

Sell the asset when the market timing is right (3-7 years), to gain returns

7

Share Proceeds:

Home Invest distributes returns to investors. Investors have the opportunity to invest gains into future purchases through 1031 exchanges

Key Benefits of Passive Investing

1

Tax Efficiency: Each investment option is structured to take full advantage of tax benefits associated with real estate, including deductions for depreciation and other incentives.

2

Customized Portfolio Diversification: Our investments span a range of property types, allowing you to diversify for stability, and enhanced growth potential.

3

Risk-Managed Portfolio: Our portfolio emphasizes B-class and C-class properties, striking a balance between growth and safety. This approach minimizes exposure to market fluctuations and prioritizes steady, predictable income streams tailored to support long-term financial goals.

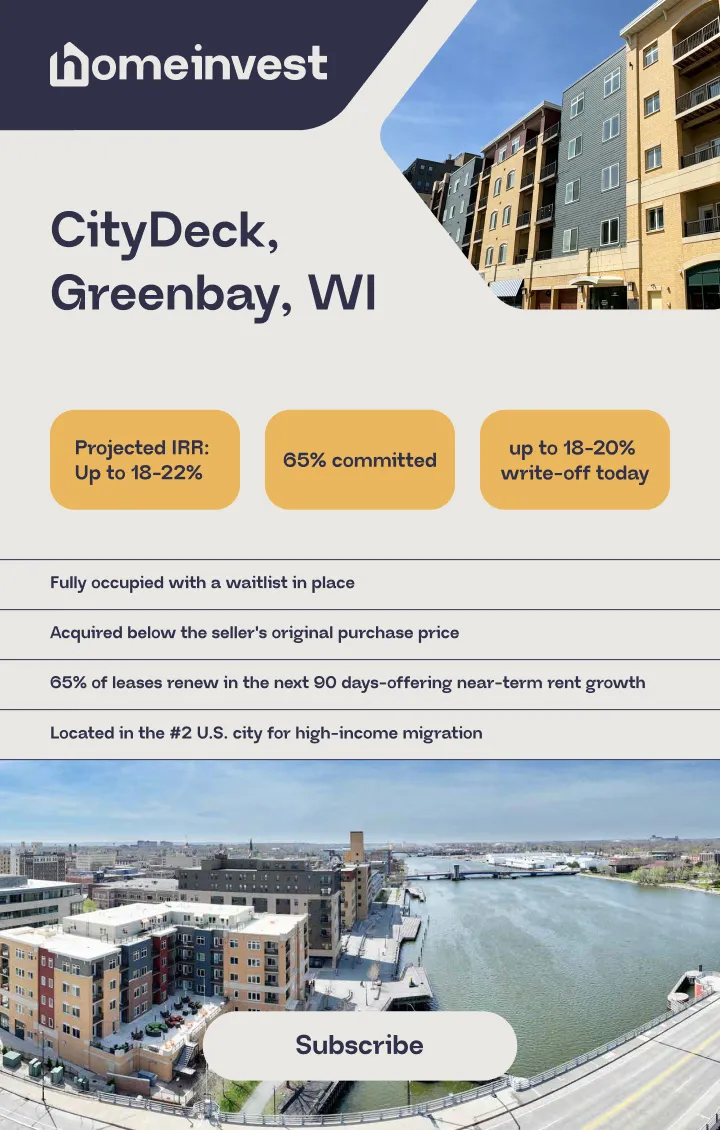

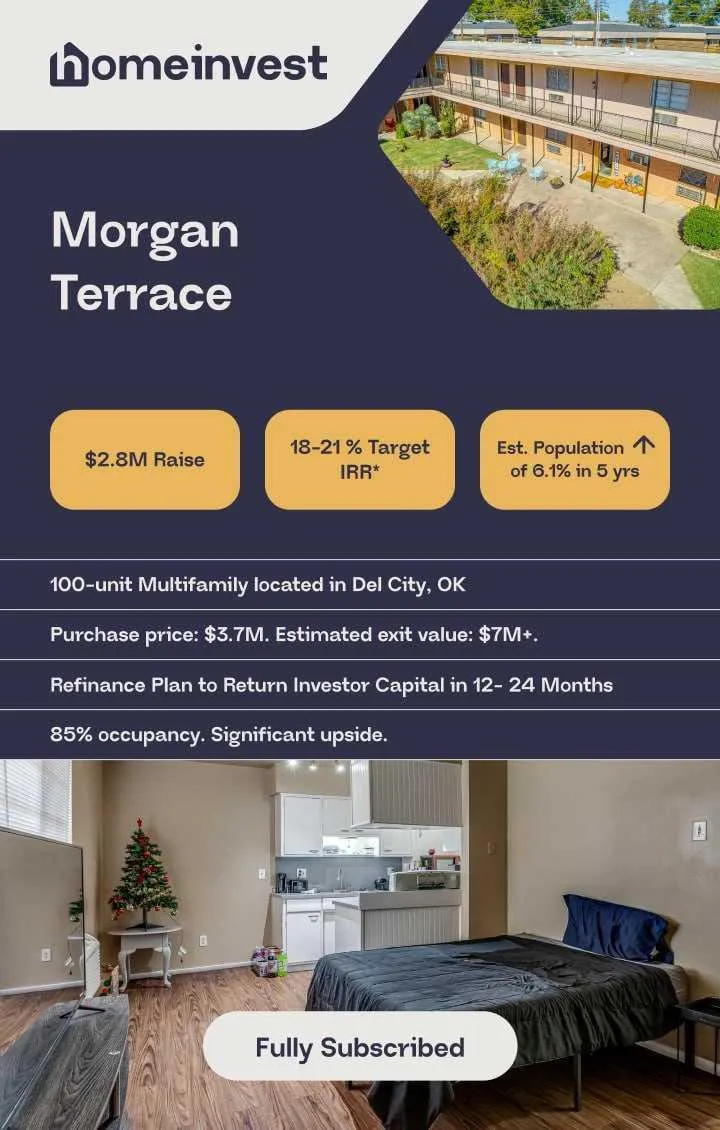

Open Investment Offerings

Our private real estate funds provide tax efficiency, low volatility, and diversification. You can invest in pre-vetted private equity transactions with expected returns, clearly projected. We pursue compelling investments, while mitigating your exposure to market volatility. You get the benefits of passive investing with tax and inflation protection while our team handles due diligence, renovations, and management.

Current

Offerings

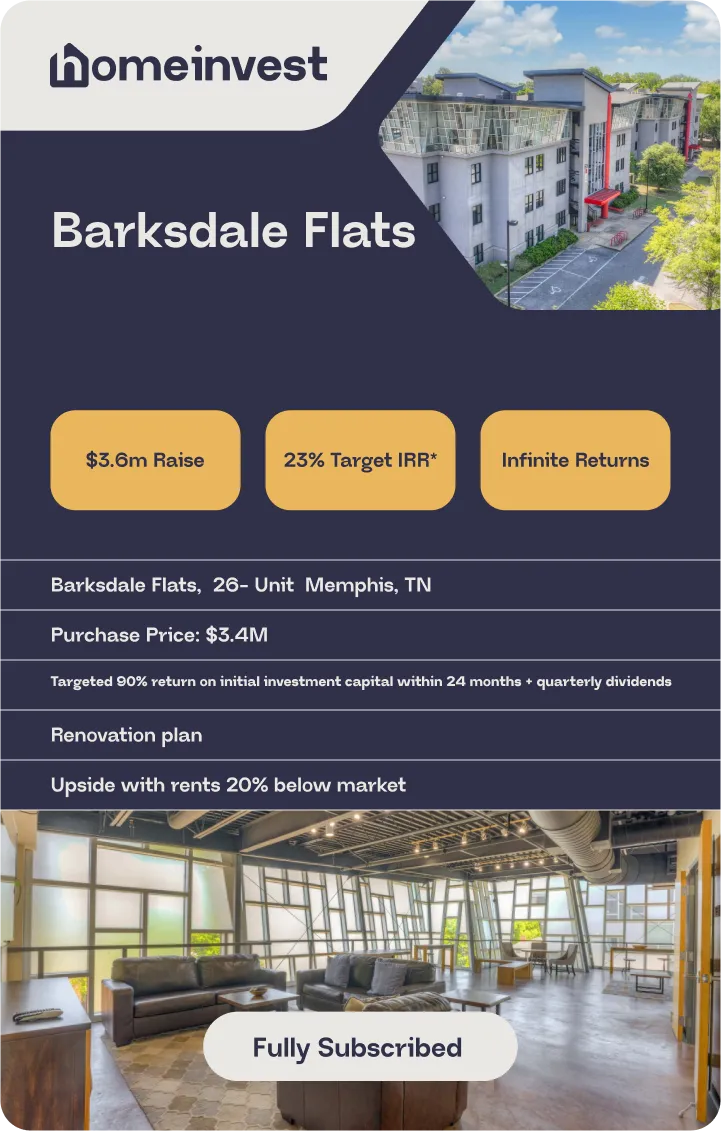

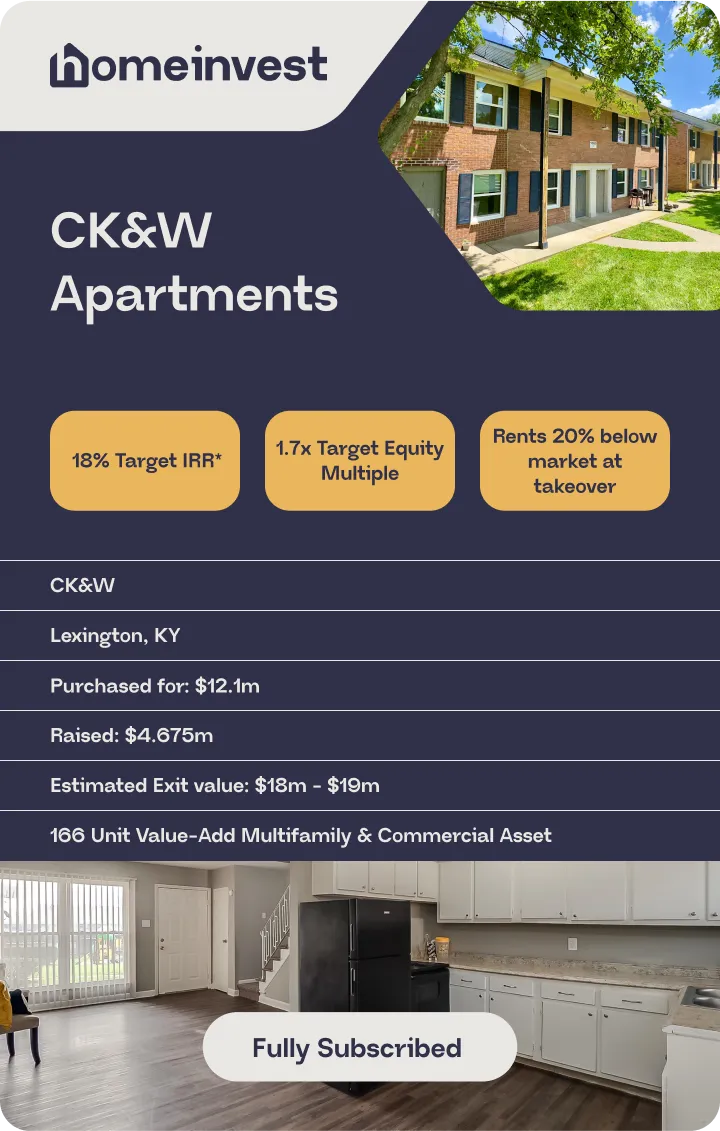

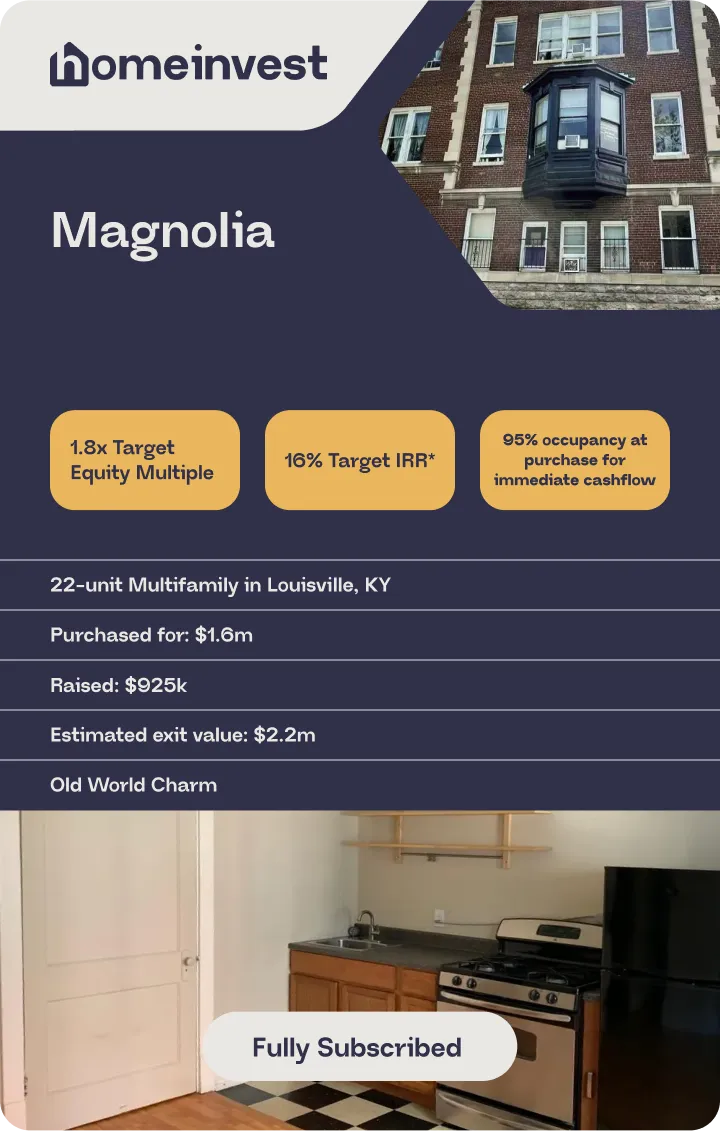

Past

Offerings

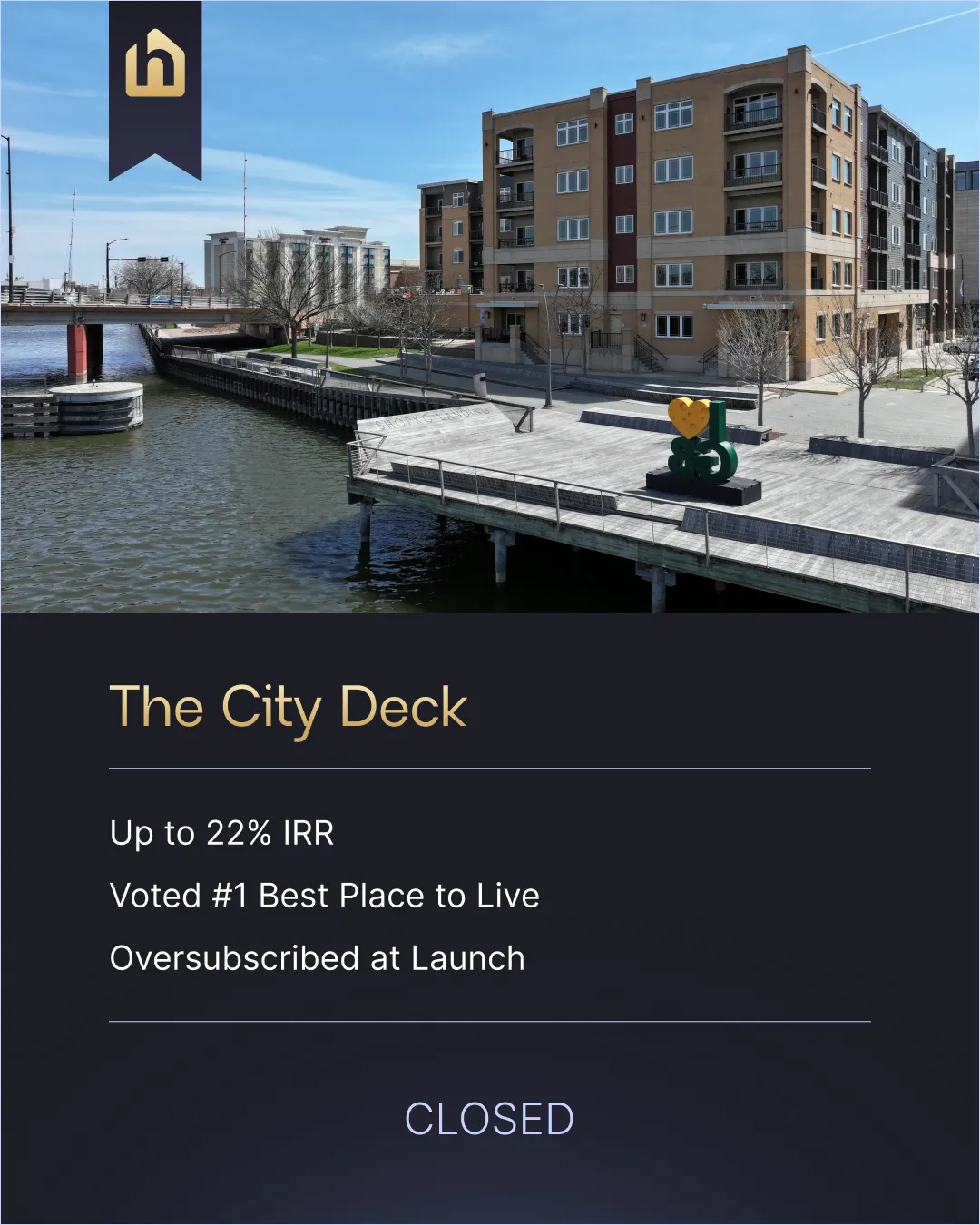

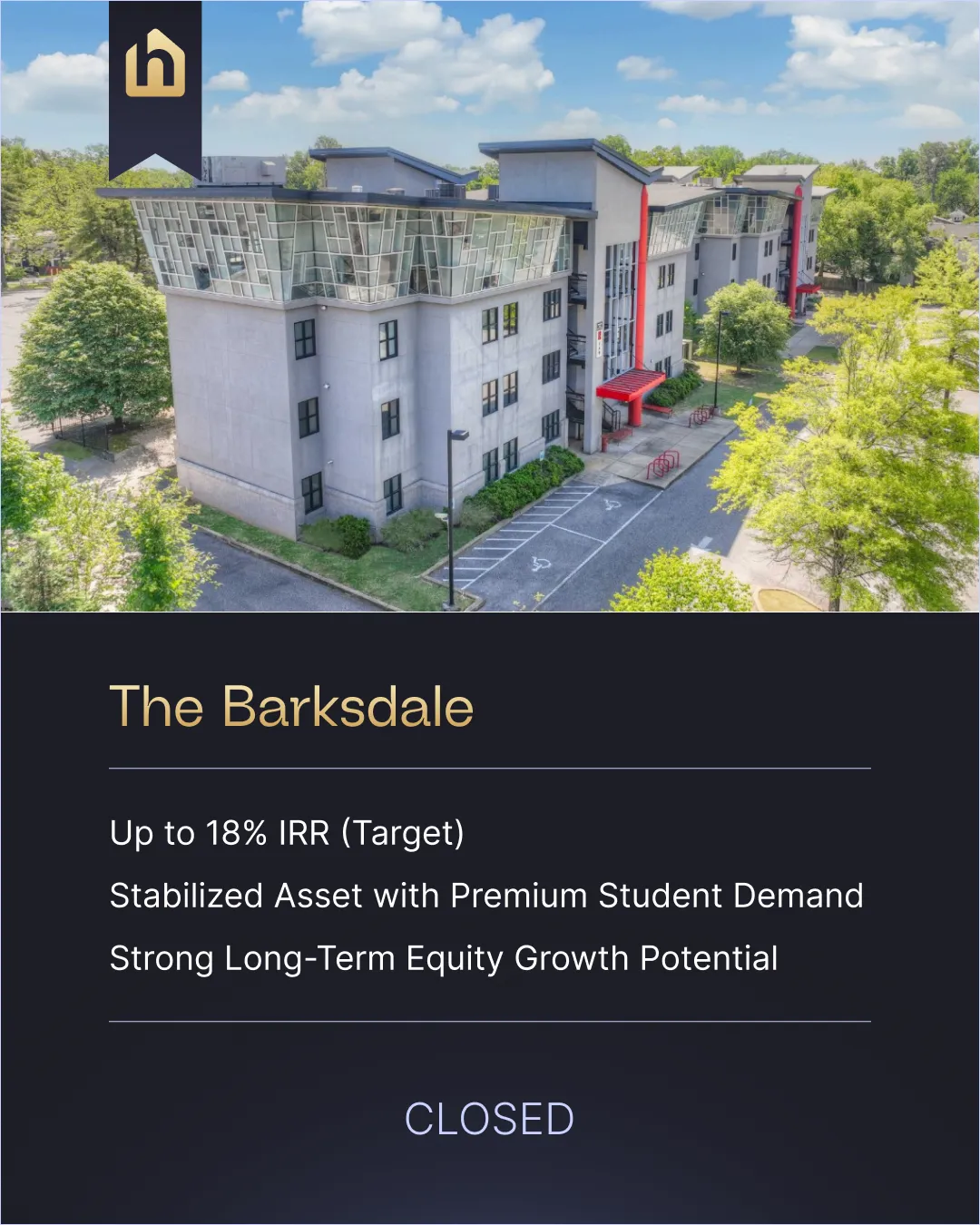

Recently Closed Offerings

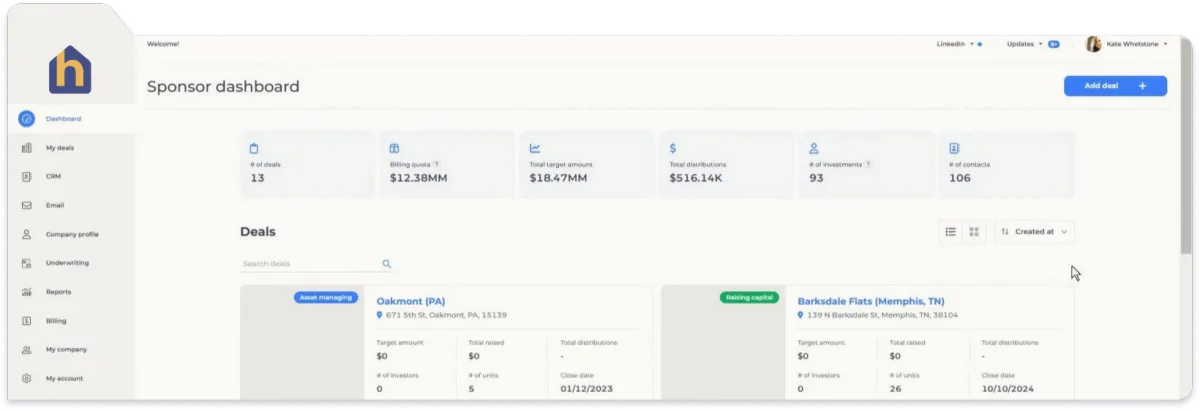

Our Investor Portal:

Transparency & Accountability at your fingertips

Track your investments through our industry-leading investor portal that allows you to monitor your investments in real-time.

1

Log In:

2

BROWSE

OPPORTUNITIES

3

CONDUCT

DUE DILIGENCE

4

FUND

INVESTMENT

5

TRACK RESULTS

Our system is easy to enter and navigate, and our advisors will walk you through registration to make sure new investors are onboarding efficiently.

Why Invest with Us?

Wealth Creation: We know your capital can do more for you through shared real estate investments. We know how to double your investments, avoid tax penalties and reinvest profitably to exceed your personal financial goals. Our personal relationships lead to off-market methods that create unique investment opportunities others miss.

Flexibility to Seize Opportunities: As a privately owned, faith-forward firm, we have the freedom to move quickly to capture investment opportunities in any location, at any point in the market cycle. Flexibility gives us a powerful advantage.

Shared Risk: We invest alongside our investment partners, so our interests are aligned because we share the same goals and risks. Our executives, are vested in mutual success in every deal.

Transparency & Accountability: Our transparent partnership model pays off as we manage risk early. We are known for our transparency and strong personal relationships with multiple stakeholders, including investors, capital partners, vendors, tenants and regulators. We believe in doing what’s right for all is simply good business.

We Believe in More: Beyond strong investment performance, we believe that investing well also means improving the lives of the people who use our properties and live in the surrounding communities.

But, don’t take our word for it. Listen to our actual investors…

Two Comma Club Award Winner

Prestigious ClickFunnels Award

22.4%*

*Up to 22.4 % IRR

1,400

Purchased and Sold (Full Cycle)

#352

Inc 500 Award Winner

*Home Invest can not and does not make any guarantees about your ability to get results or earn any money with our ideas, information, tools, or strategies.